Page 3

L.A. Attorney Milton Grimes Pleads Guilty to Tax Evasion

By Kimber Cooley, associate editor

|

|

|

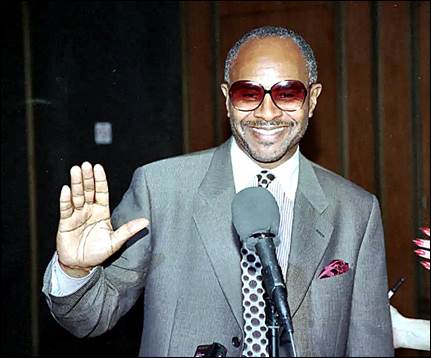

—AP Attorney Milton C. Grimes talks to the news media in Los Angeles on April 12, 1995. |

The U.S. Department of Justice yesterday announced that Los Angeles attorney Milton C. Grimes—who rose to nationwide fame for his representation of Rodney King in his civil action against the Los Angeles Police Department for the beating that sparked the deadly 1992 riots—has pled guilty to evading millions in federal taxes.

Grimes pled to a single count relating to his underpayment of federal income taxes due for 2014, admitting that he failed to pay $1.69 million owing to the IRS.

According to the department, Grimes has failed to pay over $4.07 million in federal income taxes due over the course of a 21-year period.

Attempts by the IRS to collect overdue taxes through the issuance of more than 30 levies on Grimes’ personal bank accounts were evaded by a practice of keeping consistently low balances in the levied accounts, according to federal prosecutors.

Scheme Cited

They assert that Grimes managed to keep funds in his personal accounts low through a scheme of purchasing cashier’s checks—totaling $16 million—from monies in his client trust accounts, his Interest on Lawyers’ Trust Accounts (“IOLTA”), and his law firm’s bank account.

One example highlighted by yesterday’s press release is a Dec. 5, 2018 purchase of nine cashier checks worth just over $1 million after a deposit in the same amount into his IOLTA bank account.

District Court Judge Stanley Blumenfeld Jr. of the Central District of California has scheduled a sentencing hearing on Feb. 11, 2025. Prosecutors have agreed to seek a prison sentence of no more than 22 months and up to $9.5 million in restitution.

Grimes is facing a statutory maximum of five years in prison.

Previous Tax Charge

This year’s indictment is not the first time Grimes has faced tax evasion charges. In 1988, he pled guilty to a misdemeanor tax charge in Orange Municipal Court and was ordered to pay delinquent taxes of $1,269 and a $4,000 fine.

The attorney has also made headlines over the years for litigation with former clients. After successfully obtaining a $3.8 million judgment in King’s favor in the civil action against Los Angeles, Grimes sued King for attorney fees.

In 2004, former client Lorine Harris sued Grimes for malpractice, obtaining a $1.25 million jury verdict against the attorney. Jurors found Grimes negligent in allowing Harris’ suit against Gardena Police Department to be dismissed but the judgment was later reversed on appeal.

Grimes has been the subject of disciplinary actions by the State Bar, having been twice suspended from the practice of law—once in 1983 for failure to pay bar dues and once in 1990 for his failure to file the 1988 tax returns.

In 2005, he was placed on probation by the bar for failing to comply with the terms of a 2003 public reproval ordering him to complete six hours of approved courses in attorney-client relations and to pass the Multistate Professional Responsibility Exam.

His status is currently listed as “active” with a “consumer alert” saying that “[t]his attorney has been charged with a felony.”

Copyright 2024, Metropolitan News Company